Lifetime ISA Penalties Reduced

/In response to the Covid-19 pandemic, the UK government has made some important, but currently temporary, changes to the Lifetime ISA (LISA) rules.

Here, I’ll break down what this means for you and your savings or investments.

I am not a tax advisor. Before making any financial decisions, do your own research and/or seek independent financial advice.

First, What Is A Lifetime ISA?

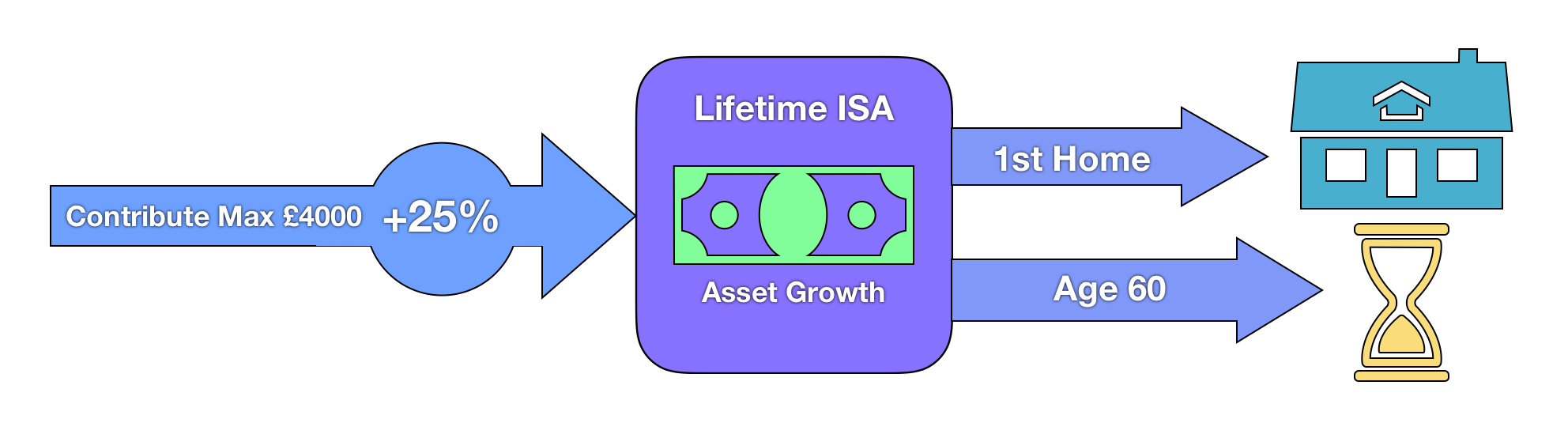

The Lifetime ISA (LISA) is a type of savings or investment account which is designed to help you save for your first home or retirement. You can withdraw the money from your LISA if you’re buying a first home (up to £450,000), age 60+ or you have a terminal illness.

You can deposit up to £4000 into a Lifetime ISA each tax year between the ages of 18 and 50 (one must be opened before you turn 40).

The UK government will add a 25% bonus to any savings you’ve made during the tax year up to a £1000 maximum bonus (bonuses paid monthly).

There are two different types of Lifetime ISA. A Cash LISA or a Stocks and Shares LISA (S&S LISA). You’ll earn interest on your savings in a Cash LISA and you’ll hold investments in a Stocks and Shares LISA (investments may go up or down).

Lifetime ISA Withdrawal Penalties Have Been Reduced

Unless you withdraw for the reasons above (first home, 60+ or terminal illness), you will be hit with a penalty.

Previously, the penalty was 25% of the amount withdrawn. It has now been reduced to 20%, backdated to the 6th of March 2020 (contact your provider if you’ve made a withdrawal and haven’t been automatically refunded the difference).

The previous 25% penalty meant you actually got back less than you originally deposited. Here’s why:

Imagine you deposit £1000. You get a 25% bonus of £250 added to the account meaning you now have £1250 in total. You withdraw £1250 for an unsanctioned reason which is hit with a 25% penalty. That means you get back £937.50 (around 6% less that the initial £1000 you contributed).

Under the new rule, which is currently only temporary (it goes back up to 25% on the 6th of April 2021) the penalty has been reduced from 25% to 20%. What does that mean?

Deposit £1000 and get a 25% bonus of £250. You make an unsanctioned withdrawal of £1250 and you’re hit with the 20% (reduced) penalty. You get back £1000. This means that HMRC effectively take back your original government bonus, you aren’t hit with an extra penalty on top.

Does This Affect Both Cash And Stocks And Shares LISAs?

Yes, in terms of the bonus and unsanctioned withdrawal penalties, both the Cash LISA and Stocks and Shares LISA (S&S LISA) are treated the same. But there’s something else to consider here.

In the case of a Cash LISA, your savings are held in cash and you get paid interest on that amount (you get interest on the bonus amount too when it gets deposited). The previous 25% penalty meant you would get back less that you put in if you made an unsanctioned withdrawal. The new 20% penalty means you’ll effectively get the bonus amount back.

In the case of a Stocks and Shares LISA, since you’ll be holding investments, you have to take into account that your balance is more volatile than money held in a Cash LISA.

HMRC May Take Back More Than They Gave You

You may actually pay the government back quite a bit more than they gave you. Imagine this scenario:

You deposit £1000 into a S&S LISA and get a 25% bonus of £250. You invest that £1250. Your investments grow by 10% and you decide to make an unsanctioned withdrawal of the full amount (£1375). HMRC takes back 20% (£275) and you get the rest (£1100). This means you’re actually paying HMRC back £25 more than they gave you in the first place. So you’re handing some of your gains over to HMRC.

If Your Investments Fall In Value, You Pay The Penalty

You deposit £1000 into a S&S LISA and get a 25% bonus of £250. You invest that £1250. Your investments shrink by 10% and you decide to make an unsanctioned withdrawal of the full amount (£1125). HMRC takes back 20% (£225) and you get the rest (£900). This means you’re paying back HMRC and you’re getting back less than you contributed because your investments have decreased in value.

More People Need To Take Advantage of the Lifetime ISA

This change shouldn’t affect the vast majority of Lifetime ISA savers and investors. Remember, you only pay a penalty if you make an unsanctioned withdrawal (ie. not withdrawing for a first home, age 60+ or terminally ill).

The Lifetime ISA is a great savings vehicle and more people need to open them. It was announced in the 2016 budget but take-up isn’t at the level it should be.

Your savings are boosted by 25% each tax year. If you managed to save the maximum £4000 each tax year for 3 years running, you’d have accrued £3000 in bonuses, plus interest. You get interest on the bonus amount too. Once it’s in your account, it’s your money.

If you’re saving for a first home, a Cash LISA likely makes the most sense. If you’re saving for retirement, a Stocks and Shares LISA likely makes the most sense.

Personally, I wish the 20% reduced penalty stayed that way. I understand that the government wants to disincentivize unsanctioned withdrawals but I think removing 20% (and effectively removing the bonus amount) does the job.

Do you have a Lifetime ISA? Have any questions? Let me know in the comments down below.

The best UK Apple News+ Deals, Trials and Savings that you’ll find in July 2025. Updated throughout the month.