A Comprehensive Guide To Starling Bank

/Full Disclaimer: This post is not paid-for nor is it sponsored by Starling Bank.

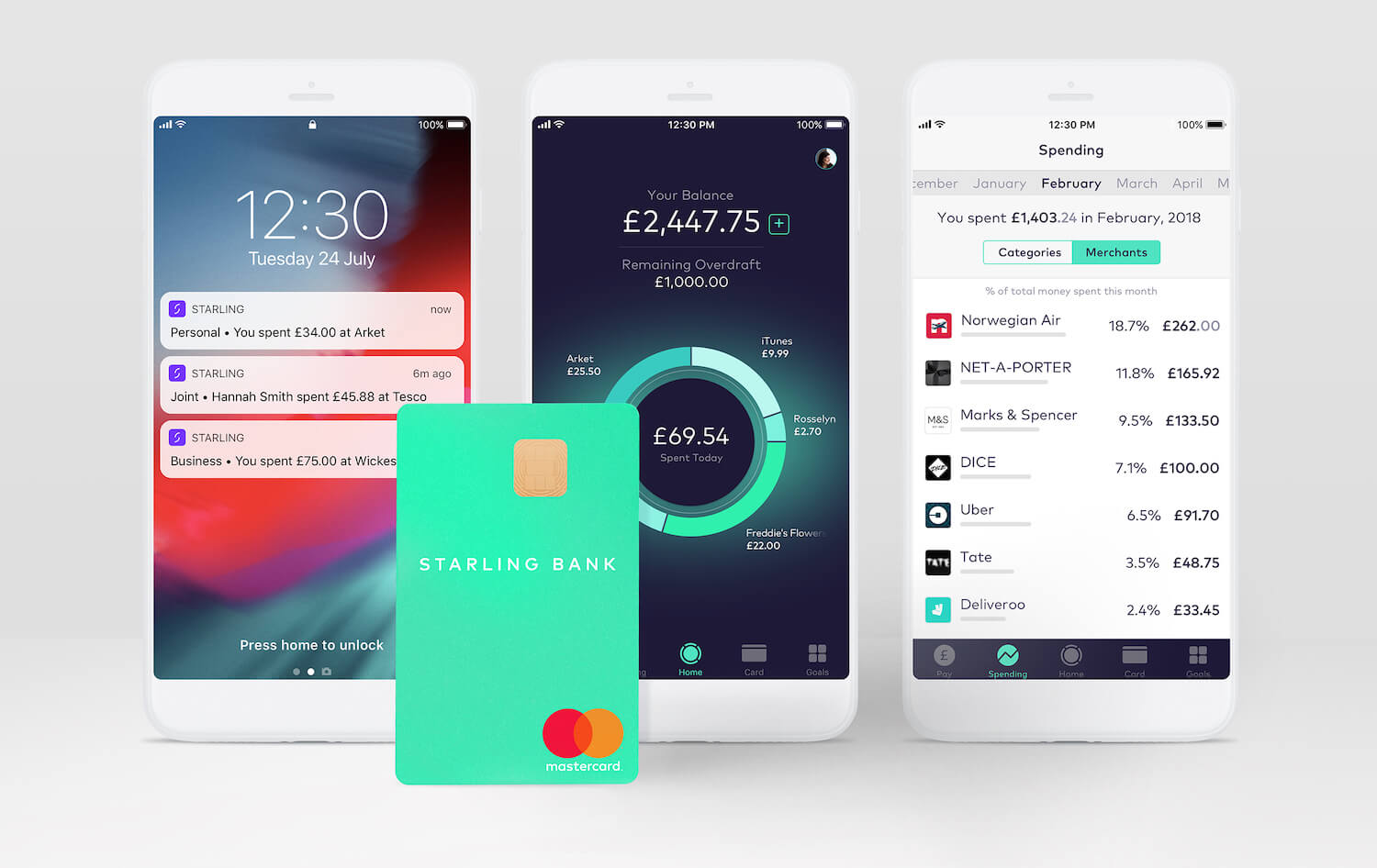

Starling Bank is the app-based mobile-only bank founded in 2014 by Anne Boden and headquartered in London. The company, and others like it, have been gaining traction in the financial world, in the last few years especially.

So what is it? How does it work? And, most importantly, can you trust it? I’m going to answer these questions and more in this comprehensive guide and review.

What Products Does Starling Bank Offer?

Starling Bank offers personal, joint and business current accounts. Unlike your traditional bank, Starling doesn’t have any branches. Instead, it’s all app-based (iOS and Android). There is an Apple app for iPhone and iPad.

That said, you will still be sent a physical card (in a rather nice sleeve too). The cards are all designed vertically, rather than horizontally, with all your standard information on the back of the card (ie. card number, sort code, account number).

The personal and business account cards are differentiated by different hues of blue. The business card is a dark navy and the personal card is a light teal.

Opening A Personal Account

I opened a personal account through Starling before a trip abroad to Venice. I did this because I wanted to take advantage of the zero international fees (I’ll go more into that later on).

Currently, any UK resident aged 16 and over can apply. You just need to download the app (on either the Apple App or Google Play Store). You will be asked a few questions and told to provide ID and record a short video selfie in order to confirm your identity.

You can switch your current account to Starling using the Current Account Switch Service (CASS).

This comes with the current account switch guarantee which basically means that in the event that you’re incurred any interest or charges on your account because of the switch, these will be refunded.

Starling do a soft-credit check when you apply for the account. This doesn’t affect your credit score. It’s only if you say yes to any offered overdraft that a hard credit check will be performed.

Is Starling Bank Safe?

App-based mobile banks are relatively new to the scene. However, the protection offered by Starling is the same as with most other major bank accounts in the UK.

Your account with Starling is protected by the Financial Services Compensation Scheme (FSCS). This means that if the bank were to become insolvent, your money is protected up to £85,000.

This puts it ahead of the competition compared to Revolut, another app-based bank, which isn’t currently covered by the FSCS.

Using Your Starling Bank Account

Paying With Starling

You will be sent a contactless mastercard debit card which should arrive within 3-5 working days.

The company is, however, highly encouraging use of digital wallets. Currently, you can use your card with Apple Pay, Google Pay, Samsung Pay, Fitbit Pay and Garmin Pay.

Adding Money To Your Account

If you want to transfer money to this account from another, you have to do this via the account you’re transferring from. You will need the account number and sort code in order to do this. You can find this in the app or on the back of your card.

There is no deposit feature on the Starling app. You have to go via the account you’re transferring from.

Cash and cheques are another matter. You can deposit cash (max. £20,000 or £250 in coins) at Post Office branches, you’ll just need your debit card. For any cash deposit larger than £2000, Starling recommend you check with your Post Office branch first.

There is no charge for depositing cash into a personal account but there is a 0.3% charge when depositing cash into a business/sole trader account.

Pound Sterling cheques made out in your name can be sent to Starling via the post.

Using Starling Abroad

This is one of the main reasons I opened an account, travel. When you use your card abroad, you won’t be charged for paying in a foreign currency and you won’t be charged ATM fees for withdrawals either.

In fact, make sure that when you’re abroad you do opt to pay in the local currency. Here’s why.

Sometimes you might be offered the option of paying in the local currency or in GBP (£). If you select the local currency, Starling does the currency exchange and it does it with no fees attached, at the mastercard interbank rate (which beats retailer rates).

When you’re abroad, if you select to pay in GBP, the retailer (ie. the restaurant, shop, museum etc.) will do the currency exchange. The exchange rate won’t be better than the interbank rate and you could be charged a fee on top. Always pay in the local currency.

When you pay or withdraw from an ATM, you will get an instant notification from Starling on your phone. This notification will let you know how much has been taken out of your account (which is all based in GBP).

Using The Starling App

They have made the app extremely easy to use. There are dedicated sections for payments, spending (merchants/categories), your card (controls, lock/unlock) and goals.

Whilst the goals section is not one I personally use, I do like how it works. Basically, you can ring-fence your money into designated sections (eg. holidays, gifts) to separate your savings in your account.

There’s another really nice, free feature called ‘Split Bill’. This is great if you’re travelling with friends/family abroad and you need to settle some money between you.

Tap on any transaction and you will see ‘Split’. If you tap on that, you can decide how you want to split your transaction (how much and with how many people). This is a really quick and easy way to avoid awkward, long term IOUs.

Starling vs Monzo vs Revolut

In my opinion, Starling beats both Monzo and Revolut.

Revolut is instantly beaten because it doesn’t offer FSCS protection. Both Starling and Monzo do offer this protection (up to £85,000).

Starling and Monzo are more comparable. Both use the mastercard interbank rate when you pay, which is great. But one major difference places Starling at the top.

Monzo currently charges users a 3% fee when they withdraw over £200 from ATMs in the space of 30 days. Starling does not charge for ATM withdrawals. You can make up to 6 ATM withdrawals daily, up to a maximum of £300.

If you have any more questions about Starling or you’re wanting to know more about the differences between Starling and other app-based banks, let me know in the comments down below.

The best UK Premier Sports Deals, Trials and Savings that you’ll find in July 2025. Updated throughout the month.