Rebalancing Your Investments: A Comprehensive Guide

/When you make the decision that you want to control your own investments, you will likely create a portfolio that you are wanting to stick to over the long term. Whatever that consists of, stocks, bonds, index funds, ETFs, you will have decided how you want your portfolio to be broken down.

You might aim for 10% each in 10 different companies, or 25% each in 4 different funds. Whatever your aim, your original allocation will change over time. This is simply because some investments will do better than others.

Diverging Returns Skew Your Portfolio

Diverging returns will skew your portfolio away from your initial allocations. As a simple example (illustrated below) imagine you want to invest in 2 funds, in equal proportion. 50% in ‘Fund A’, 50% in ‘Fund B’. You want your investments to grow but you want to keep that 50/50 split to manage your long term risk.

Now imagine that in year 1, ‘Fund A’ grows by 10% and ‘Fund B’ grows by 5%. This results in a skew towards ‘Fund A’, away from your target 50/50 split. If ‘Fund A’ continues to outpace ‘Fund B’ in terms of growth, this will skew your portfolio further and further from your target.

What Is Portfolio Rebalancing?

If you want to address portfolio skewing, you do have the option to rebalance. When you rebalance, you are effectively selling and/or buying assets to skew your portfolio back towards the initial target allocation.

Logically, you might have to sell some of your best performing assets to buy some of your worst. This might seem counterintuitive but you have to remember why you selected your target allocation in the first place.

You concluded that, using the above example, a 50/50 split minimised the overall risk of your portfolio. Your best performing assets might be performing well currently, but this might change in the future.

How To Buy And Sell To Rebalance

If your portfolio has been skewed, how do you calculate how much you need to sell and buy in order to readjust? Let’s say your current 4-fund portfolio is split 36%, 29%, 28% and 7%. Your target is set at 35%, 30%, 30% and 5%.

First, calculate the total value of your entire portfolio (eg. £10,000). Then work out what the target value of each fund should be. For example, the fund which currently makes up 36% of your investments (£3,600) should be sitting at £3,500 (35%). Withdraw the appropriate value from that fund (£100) and any other funds which are over their target allocation. Then deposit the appropriate amount of money into the under-represented funds.

Fractional Shares

Rebalancing portfolios in which you cannot own fractional shares (eg. 0.5% of one share) can be difficult to rebalance exactly. As an example, Apple shares (AAPL) are valued in the hundreds of dollars. A growing share price without a stock split might inhibit your ability to accurately rebalance. If this is the case, rebalance as close to your initial target as you can.

Benefits Of Rebalancing Investments

No Rebalancing shifts your risk profile

As an unbalanced portfolio goes unchecked, it’s risk profile changes. Take the case of a 50/50 stock/bond portfolio. Stocks, historically, have outperformed bonds over the long term. As you would imagine, an unchecked portfolio with a 50/50 stock/bond split would become more skewed towards stocks, a riskier asset class with than bonds. As this occurs, the portfolio inherits greater risk. But with greater risk, over the long term, comes greater returns.

Annually Rebalanced vs Unchecked Portfolio

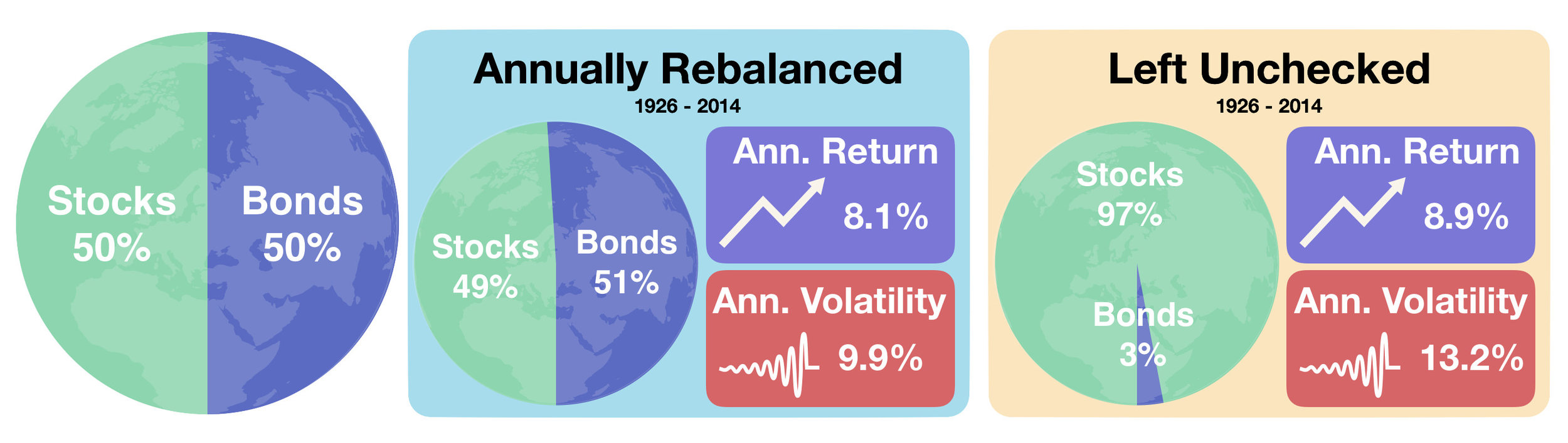

Vanguard, in 2015, demonstrated this phenomenon. They created a hypothetical portfolio consisting of 50% global stocks and 50% global bonds. They then compared the effects between an annually rebalanced portfolio and an unchecked portfolio existing between 1926 and 2014.

The rebalanced portfolio had an average annualised return of 8.1% and the unchecked portfolio had an annualised return of 8.9%. The major difference was observed in the final portfolio weightings. The rebalanced portfolio had a final stock weighting of 49%. The unchecked portfolio had a 97% final stock weighting.

As the weighting towards stocks increased over time (to a final 97%), the risk increased. The greater risk generated greater rewards (an 8.9% annualised average return compared to 8.1%). But the volatility also increased.

The annualised volatility of the unchecked portfolio was 3.3% higher than the rebalanced portfolio (13.2% compared to 9.9%). The unchecked portfolio produced greater returns but the portfolio was not even close to the initial 50/50 target.

This is an interesting observation because a lot of investors, including myself, want to decrease their exposure to riskier assets as they age. This portfolio, instead, drifts in the opposite direction.

Portfolio Rebalancing Strategies

There is no one-way to rebalance a portfolio. If you want to rebalance, you will need a strategy. I have outlined a few portfolio rebalancing techniques below, taking into account the advantages and disadvantages of each.

Time-Scheduled Rebalancing

This strategy involves rebalancing after a designated period of time (eg. monthly/quarterly/annually). I would facilitate this using phone/calendar reminders. A major benefit of this method is ease of implementation.

You set a schedule and stick to it. I think this also reinforces healthy long-term investing behaviour as a schedule can help minimise emotion-based decision-making.

Rebalancing with greater frequency (ie. monthly, not annually) will keep your portfolio more consistently in-line with your target. However, with greater frequency comes active management. A schedule that suits someone else might not suit you. Plus, rebalancing might physically cost you more in trading costs.

The impact of this, of course, depends on your specific investments and investment platform. If you can buy and sell for free, trading costs will not be a factor. Even if this is the case, tax planning will be required.

Threshold Rebalancing

This strategy is less regular than a time-based method. You set a threshold and only rebalance if that threshold is crossed. A threshold, in this case, could be the percentage deviance from your target investments. For example, your strategy could be to rebalance if your portfolio deviates from your target by 5%. The exact percentage is up to you.

It is more likely that thresholds will be crossed if your portfolio contains assets with greater risk-diversity. For example, a stock/bond portfolio tends to have high risk-diversity. Stocks are much risker than bonds. Therefore, deviations are more likely to occur and thresholds might be crossed more frequently.

Unlike a time-scheduled method, this strategy involves constant portfolio monitoring. You might be able to set up a notification system online which lets you know when a threshold has been crossed. However, the feasibility of this idea is very dependent on your specific circumstances.

The Time-Threshold Combination

Of course there is nothing stopping you from combining approaches. For example, you might opt to rebalance either annually or if a 5% threshold is crossed. This method allows you to stick to a schedule and react if your portfolio has deviated too far from your target in the meantime.

Essentially, the threshold is a backstop so your risk profile is maintained in the event of a more dramatic change in asset performance. This does mean you have to monitor your investments and stick to a regular schedule.

Also bear in mind that any method that incorporates asset-monitoring means you will be aware of the performance of your investments day-to-day. This could increase the likelihood that you make an emotion-based decision.

Cash Flow Rebalancing

A cash flow strategy can be implemented in addition to any other method.

It involves using income (eg. dividends, interest, regular work income) to top-up poorer performing assets. Using the 2-fund example above (‘Fund A’ and ‘Fund B’), assume both funds produce dividend income. These dividends are likely added to your investment account in the form of cash.

You can use this income to reinvest and rebalance simultaneously. So in this case, you would take the income and reinvest more/all of it into ‘Fund B’ as a top-up. I like this strategy because it encourages regular investment and it is really easy to implement.

If your cash flow is not sufficient to implement a complete rebalance, you can then use the sell and buy strategy (outlined at the start of this article).

In Combination With Drip-Feed Investing

If you have come into a sudden windfall of money, or you are deciding to invest for the first time, you may have a lump sum to invest. If this is the case, you have a decision to make. You can either invest the entire amount, lump sum, or you can drip-feed that sum into the market. If you decide to drip-feed, you can rebalance your portfolio as you do so, instead of selling assets or using additional income.

For example, a lump sum of £12,000 could be drip-fed into the market over 12 months. You could split this £12,000 into 12 equal chunks of £1000 and invest regularly each month. Let’s say your target portfolio is made up of 4 funds, 25% each. After the 1st month, your portfolio may have skewed slightly from your target. So instead of splitting the next £1000 sum equally (25% each), you might skew these to rebalance your portfolio.

Of course, whilst you can rebalance as you drip-feed a sum of money, it is likely that this process won’t last too long. Drip-feeding a lump sum is usually a process which takes a year or two. Although this is not a long term solution it can be used to rebalance in the short to medium term.

Whatever strategy you pick, Pick a strategy and stick to it. Consistency is key with long-term investing.

Don't Forget Dealing Costs

Whenever you buy or sell an investment, there may be dealing costs. These can significantly eat into your returns over time. If this is the case, there might be an alternative platform which has less/no dealing costs. If you have a stocks and shares ISA specifically, you could look into transferring. If you do have to pay every time you buy/sell, rebalancing can become costly.

Rebalancing annually, rather than quarterly, will be cheaper but remember, the longer the delay, the more likely your risk deviates from your target.

Conclusion

If you do decide that you want to rebalance, pick a strategy and stick to it. Choose the strategy that best suits you. There are a lot of factors (dealing costs, your risk profile, asset class, time etc.) which make the ideal strategy differ between individuals.

Thank you for your attention, remember to hit the like button down below. What do you think of portfolio rebalancing? Is it necessary? If so, how often and what strategy should you use?

If you’re looking for resources to better your own personal finances, here are some of my recommendations:

Savings/Investment Spreadsheet Downloadable - 10% of profits go to a charitable cause.

Facebook - UK Passive Investing Group - Join A Like-Minded Community

Check out my offers page to earn some free money and grab some freebies.

Rich Dad, Poor Dad by Robert Kiyosaki

The Little Book of Common Sense Investing by John C Bogle

The Intelligent Investor by Benjamin Graham

References

Zilbering, Y., Jaconetti, C. M., & Kinniry Jr, F. M. (2015). Best practices for portfolio rebalancing. Valley Forge, Pa.: The Vanguard Group. Vanguard Research PO Box, 2600, 19482-2600.

The best UK free share referral offers, updated throughout July 2025. Get free stocks and shares with Shares App, FreeTrade, Stake and more.